Financial Calculator™ FREE

★★★★★★★★★★★★★★★★★★★★

Simple and intuitive interface with this calculator,

everyone may calculate followings without the knowledge on complicated equation or terms.

★★★★★★★★★★★★★★★★★★★★

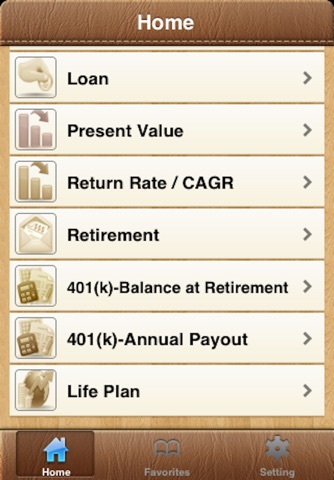

► Simple and Compound Interest.

- Simple Interest/Compound Interest

► Growing annuities and Present Value of Annuity.

- Annual Payout Amount

► Calculates N, Interest, Present Value, PMT and Future Value of money.

- Compound Annual Growth Rate/Future Value/Present Value

► Bond Yield calculator.

- Current Yield/Yield to Maturity

► Amortization and Loans calculator.

- Monthly Payment

► Return Rate/CAGR calculator

- Compound Annual Growth Rate

► Retirement calculator.

- Annual Retirement Income

► 401(k) calculator.

- Balance at Retirement/Annual Payout Amount/Taxes

► Life Plan calculator.

- Success Percentage

*****************************

◆ This calculator does not just calculate interest.

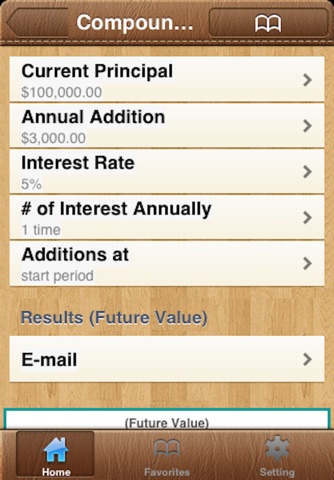

◆ Please select one element among principal, interest rate, period or total amount.

◆ You may calculate the element you want to know.

◆ If you just enter three elements in the form, the calculator will indicate the other element you want to know together with monthly amount and graph beautifully.

*****************************

ex1) What is the accumulated value of a series of payment of USD1,000 each month, accumulating at an interest rate of 10% per year, for 10 years.

ex2) How much monthly payments should be paid to yield an accumulated value of USD50,000 at the end of 5 years assuming interest rate 7% per year.

ex3) Stocks bought 10 years ago at the price of USD10,000 became an accumulated value of USD30,000. What is the yearly compound interest rate?

ex4) How long period needed to yield accumulated value of USD10,000 with monthly deposits of USD50,000 assuming annual 5% interest rate.

ex5) If a man bought a house at USD300,000 and sold at USD500,000 10 years later. What is the annual rate of return?

ex6) Assuming annual inflation rate 3%, what is the present value of USD1,000,000 at the end of 10 years.

ex7) If you want to borrow money with minimum interest, what is the best way?

ex8) If you want to redeem your loan with equal monthly payments in 10 years. What is the method with monthly payments amount?

ex9) There is a new car you want to buy. You can not afford to buy the new car so you want to wait until you can buy a secondhand car. How much will it be?

ex10) You put USD20,000 into your stock account 3 years ago and withdrew USD5,000 6 months ago. If your stock valuation is USD30,000 what is the accumulated earning rate and yearly earning rate?

★★★★★★★★★★★★★★★★★★★★

➠Do the above questions seem complex?

➠ You can calculate all the answers you want know without financial knowledge with the calculator.

★★★★★★★★★★★★★★★★★★★★